The financial stability and growth of Missouri are deeply tied to its tax revenue system. As a primary funding source for public services, understanding how taxes are collected, allocated, and managed is critical for residents, businesses, and policymakers. This article delves into Missouri's tax structure, its economic impact, and the vital role it plays in supporting public services.

Taxes are instrumental in shaping Missouri's infrastructure, education, healthcare, and public safety systems. By examining the various sources of Missouri tax revenue, we gain a deeper understanding of how the state sustains its operations and meets the needs of its population. This article will explore the different facets of Missouri's tax framework, including its major revenue streams and the challenges it faces.

For taxpayers, entrepreneurs, and policymakers alike, a clear understanding of Missouri tax revenue is essential for making informed decisions. From income taxes to sales taxes, this article provides an in-depth look at the state's financial structure and its implications for the future.

Read also:Austin Botanical Gardens A Natural Escape In The Heart Of Texas

Deciphering Missouri Tax Revenue

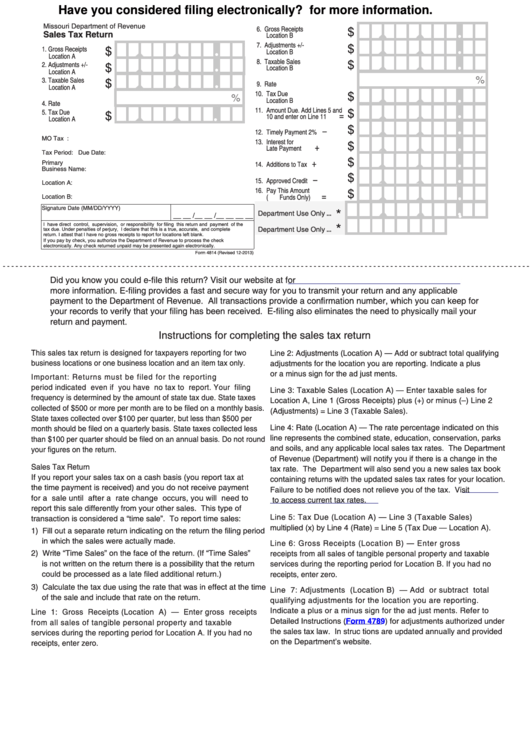

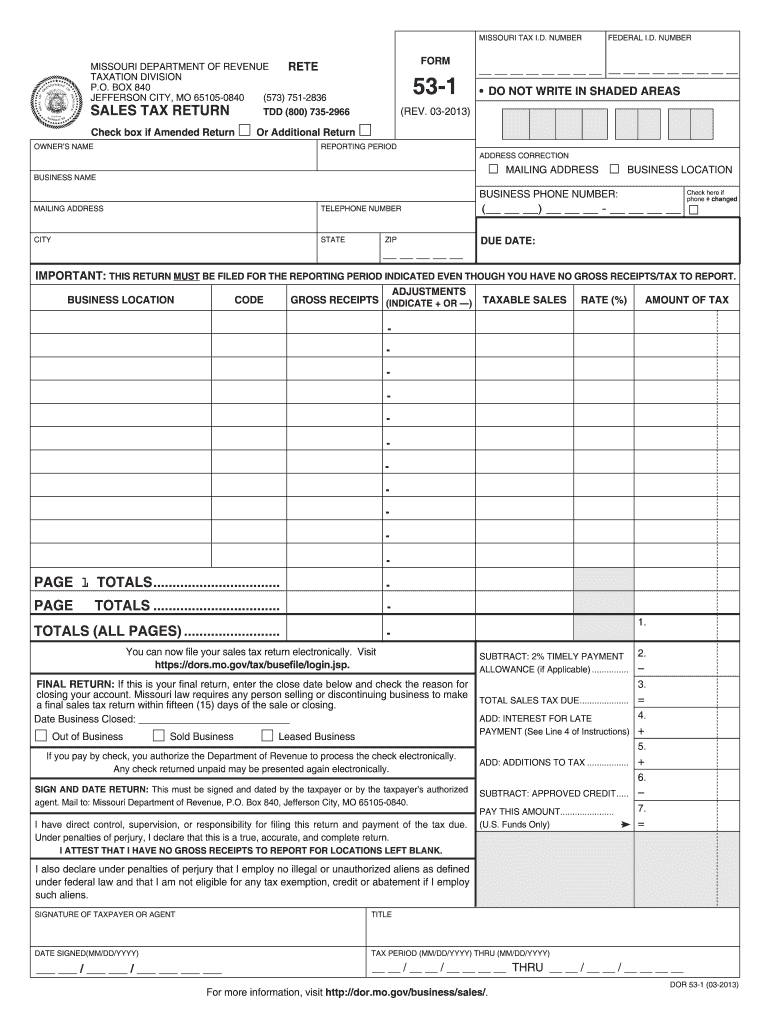

Missouri derives its tax revenue from multiple sources, each contributing significantly to the state's budget. The primary contributors include individual income taxes, sales taxes, corporate taxes, and excise taxes. These revenues are crucial for funding essential public services such as education, healthcare, transportation, and law enforcement.

The Missouri Department of Revenue is responsible for overseeing the collection and management of these funds. By analyzing trends and patterns in tax revenue, policymakers can make well-informed decisions to address economic challenges and enhance the quality of life for residents.

Primary Sources of Missouri Tax Revenue

- Individual Income Tax: This is the largest source of revenue for Missouri, accounting for nearly 40% of the state's total tax income.

- Sales Tax: Missouri's sales tax plays a significant role in the state's budget, with a statewide rate of 4.225%.

- Corporate Tax: Although smaller compared to income and sales taxes, corporate taxes remain an important part of Missouri's revenue generation.

- Excise Taxes: These taxes are imposed on specific goods and services, such as gasoline, alcohol, and tobacco products.

Historical Trends in Missouri Tax Revenue

Over the past decade, Missouri tax revenue has experienced fluctuations influenced by economic changes, policy adjustments, and external factors such as the global pandemic. Despite these challenges, the state has managed to maintain a relatively stable revenue flow by diversifying its tax base.

Data from the Missouri Department of Revenue shows that income tax collections have steadily increased, reflecting a growing economy and rising employment rates. However, sales tax revenue has been affected by shifts in consumer behavior and the rise of e-commerce, presenting new challenges for the state's fiscal strategy.

Factors Impacting Missouri Tax Revenue

- Economic Growth: A thriving economy has a direct impact on tax revenue, as more individuals and businesses contribute to the state's financial resources.

- Policy Changes: Legislative actions, including tax rate adjustments and incentives, can significantly influence revenue collection.

- External Shocks: Events like recessions or pandemics can temporarily disrupt revenue streams, requiring strategic responses from policymakers.

The Crucial Role of Missouri Tax Revenue in Public Services

Missouri tax revenue is essential in funding public services that benefit residents statewide. From education to healthcare, these funds ensure that essential services are accessible and effective. Efficient resource allocation allows Missouri to address the needs of its population while promoting economic growth.

Education is one of the largest recipients of Missouri tax revenue, with significant investments in public schools, universities, and vocational training programs. Similarly, healthcare services, including Medicaid and public health initiatives, rely heavily on state funding to provide affordable and accessible care.

Read also:Crestwood Baptist Church Crestwood Ky A Place Of Faith Fellowship And Community

Allocation of Missouri Tax Revenue

- Education: Around 40% of Missouri's tax revenue is allocated to public education, ensuring quality learning opportunities for students.

- Healthcare: A substantial portion of the budget supports healthcare services, including Medicaid programs and public health initiatives.

- Transportation: Tax revenue funds infrastructure projects, such as road maintenance and public transportation systems.

Challenges Confronting Missouri Tax Revenue

Despite its importance, Missouri tax revenue faces several challenges that could impact its sustainability in the long term. These challenges include economic uncertainties, demographic shifts, and legislative constraints. Addressing these issues requires innovative solutions and collaboration among stakeholders across the state.

A primary concern is the growing reliance on sales tax revenue, which may not keep up with inflation or changes in consumer behavior. Additionally, the state must balance the need for revenue generation with the goal of fostering a business-friendly environment.

Possible Solutions to Missouri Tax Revenue Challenges

- Tax Reform: Implementing comprehensive tax reform could help stabilize revenue streams and reduce reliance on specific tax sources.

- Infrastructure Investments: By investing in infrastructure, Missouri can attract businesses and create jobs, thereby boosting tax revenue.

- Technology Adoption: Leveraging technology to streamline tax collection and management can improve efficiency and reduce administrative costs.

Missouri Tax Revenue and Economic Growth

Missouri tax revenue plays a pivotal role in driving economic development within the state. By investing in key sectors such as education, infrastructure, and innovation, Missouri can create a favorable environment for businesses and entrepreneurs. This, in turn, generates additional tax revenue and promotes long-term economic growth.

Missouri's strategic location and diverse industries make it an appealing destination for businesses looking to expand or relocate. By effectively leveraging its tax revenue, the state can enhance its competitive advantage and attract new investments.

Strategies for Boosting Economic Development

- Workforce Development: Investing in education and training programs ensures that Missouri's workforce is equipped with the skills needed for emerging industries.

- Incentive Programs: Offering tax incentives and grants to businesses can encourage investment and job creation within the state.

- Partnerships: Collaborating with local governments, universities, and private sector organizations can foster innovation and drive economic growth.

Data and Statistics on Missouri Tax Revenue

According to the latest data from the Missouri Department of Revenue, the state collected approximately $11.5 billion in tax revenue during the fiscal year 2022. This figure represents a 5% increase compared to the previous year, reflecting a recovering economy and improved employment rates.

Further analysis reveals that income tax accounted for $4.6 billion, while sales tax contributed $3.8 billion to the total revenue. Corporate taxes and excise taxes added an additional $1.2 billion and $1.9 billion, respectively.

Key Statistics on Missouri Tax Revenue

- Total Tax Revenue (FY 2022): $11.5 billion

- Income Tax Contribution: $4.6 billion

- Sales Tax Contribution: $3.8 billion

- Corporate Tax Contribution: $1.2 billion

- Excise Tax Contribution: $1.9 billion

Missouri Tax Revenue and Policy Implications

The collection and allocation of Missouri tax revenue are heavily influenced by state policies and legislative decisions. These policies shape the tax structure, determine spending priorities, and impact the overall economic landscape of the state. Policymakers must carefully consider the implications of their decisions to ensure that tax revenue is used effectively and equitably.

Recent policy changes, such as tax rate adjustments and incentive programs, aim to stimulate economic growth while maintaining fiscal responsibility. However, ongoing debates surrounding tax reform highlight the complexities of balancing competing interests and priorities.

Key Policy Issues in Missouri Tax Revenue

- Tax Rate Adjustments: Adjusting tax rates can influence revenue collection and economic activity, requiring careful consideration by policymakers.

- Incentive Programs: Designing effective incentive programs is essential for attracting businesses and fostering economic development.

- Equity and Fairness: Ensuring that the tax system is fair and equitable remains a critical concern for residents and policymakers alike.

Conclusion

Missouri tax revenue is a cornerstone of the state's financial health and stability. By understanding its sources, trends, and challenges, we can appreciate the vital role it plays in funding public services and driving economic development. From education to healthcare, transportation to innovation, tax revenue supports the infrastructure and initiatives that benefit Missouri residents.

To ensure the sustainability of Missouri tax revenue, policymakers must address existing challenges through strategic reforms and collaborative efforts. By investing in education, infrastructure, and innovation, the state can create a favorable environment for businesses and residents, fostering long-term economic growth.

We invite you to share your thoughts and insights on Missouri tax revenue by leaving a comment below. Additionally, feel free to explore other articles on our site for more information on related topics. Together, we can contribute to a deeper understanding of Missouri's financial landscape and its implications for the future.

Table of Contents

- Deciphering Missouri Tax Revenue

- Historical Trends in Missouri Tax Revenue

- The Crucial Role of Missouri Tax Revenue in Public Services

- Challenges Confronting Missouri Tax Revenue

- Missouri Tax Revenue and Economic Growth

- Data and Statistics on Missouri Tax Revenue

- Missouri Tax Revenue and Policy Implications

- Conclusion