In the modern era of digital banking, having a clear understanding of the financial systems is essential. One of the key components of banking transactions is the ABA number, which plays a pivotal role in ensuring smooth financial operations. If you're asking, "What exactly is an ABA number?" you've come to the right place. This article will provide a thorough explanation of ABA numbers, their importance, and how they operate within the banking infrastructure.

As the world continues to move toward more digital financial transactions, it’s increasingly important to understand the underlying systems that make these transactions possible. ABA numbers are a fundamental part of this infrastructure, ensuring that funds are transferred accurately and efficiently between financial institutions.

This detailed guide will explore the concept of ABA numbers, their significance, and their impact on your banking activities. Whether you're a business owner or an individual managing personal finances, this information will empower you to navigate the complexities of banking systems with greater confidence and precision.

Read also:Discover The Best Dining Experience At Shuckers Carrollton Ga

Table of Contents

- Understanding ABA Numbers

- The Origins and Evolution of ABA Numbers

- The Structure of an ABA Number

- Practical Uses of ABA Numbers

- How to Locate Your ABA Number

- Differences Between ABA and ACH Numbers

- Why ABA Numbers Are Crucial

- Ensuring the Security of Your ABA Number

- Frequently Asked Questions About ABA Numbers

- Final Thoughts

Understanding ABA Numbers

An ABA number, also referred to as a routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. This code serves as a unique identifier, allowing banks and credit unions to process checks, wire transfers, and other financial transactions seamlessly. The ABA number plays a vital role in ensuring that funds are directed to the appropriate institution during these transactions.

When setting up direct deposits, automatic payments, or transferring money between accounts, the ABA number ensures the accuracy and efficiency of the process. Without it, financial transactions could face delays or be routed to incorrect institutions, leading to potential complications.

How ABA Numbers Operate

ABA numbers function by providing a standardized method for identifying financial institutions. When a transaction is initiated, the ABA number is used to pinpoint the specific bank or credit union involved. This ensures that funds are transferred precisely and promptly, minimizing errors and enhancing the overall efficiency of the banking system.

The Origins and Evolution of ABA Numbers

The American Bankers Association (ABA) introduced ABA numbers in 1910 to address the growing complexity of the banking system. At the time, there was a pressing need for a standardized method to streamline operations and improve the accuracy of financial transactions.

Since their introduction, ABA numbers have evolved significantly to adapt to technological advancements and the ever-changing financial landscape. Today, they remain an indispensable component of the U.S. banking infrastructure, facilitating a wide range of financial activities.

The Evolution of ABA Numbers

- 1910: ABA numbers were first introduced to standardize bank identification.

- 1940s: These numbers became integral to check processing systems.

- 1970s: The system expanded to include electronic transactions, further enhancing its utility.

- Present Day: ABA numbers are now used for a variety of financial transactions, reflecting their continued relevance in the modern banking era.

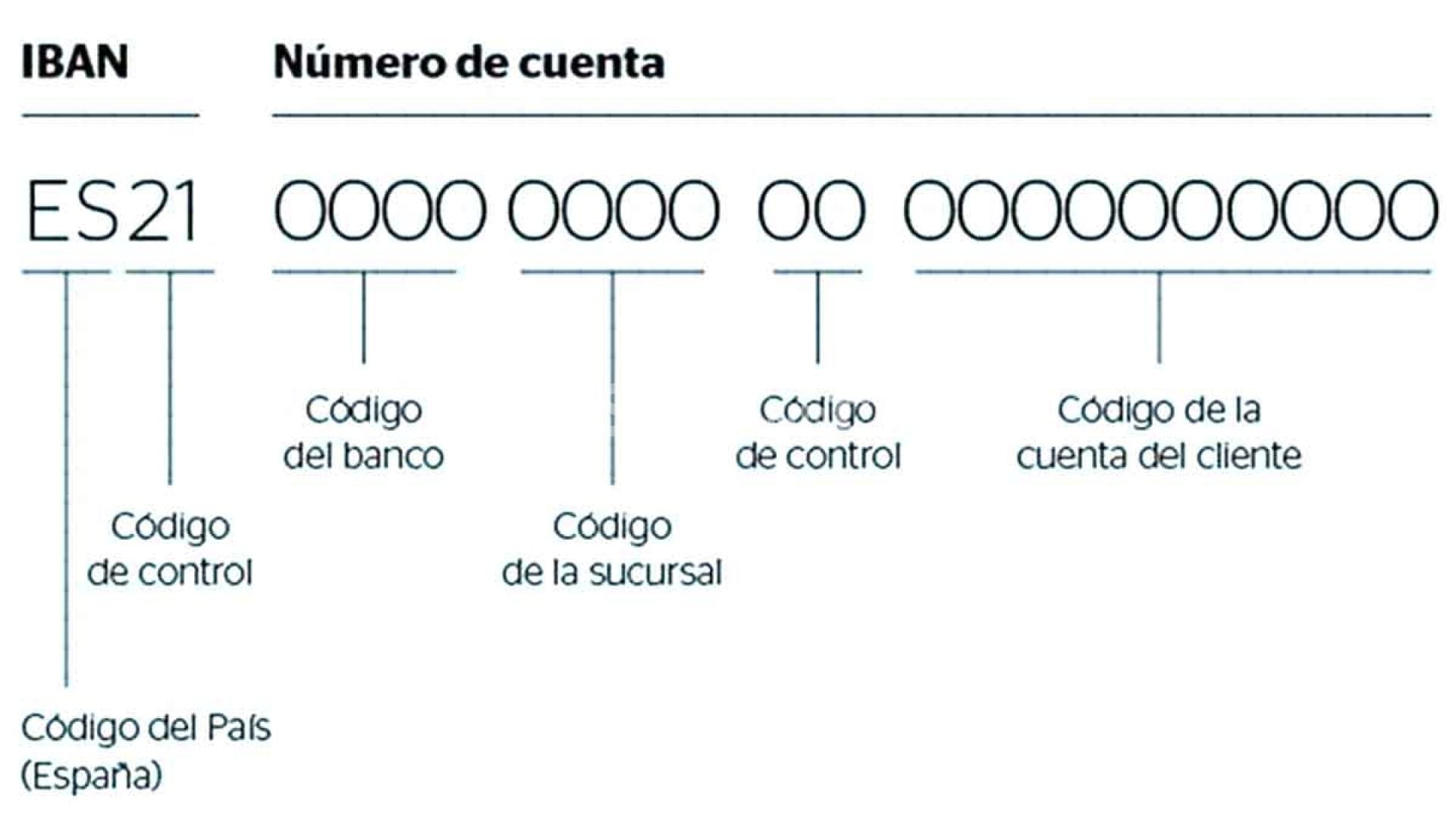

The Structure of an ABA Number

An ABA number is composed of nine digits, each with a specific purpose:

Read also:Niles Secretary Of State Everything You Need To Know

- The first four digits represent the Federal Reserve routing symbol, identifying the Federal Reserve district where the bank is located.

- The next four digits are the unique identifier assigned to the specific bank or credit union.

- The final digit serves as a check digit, used to verify the validity of the ABA number.

For example, consider the ABA number 123456789:

- 1234: Federal Reserve routing symbol

- 5678: Unique bank or credit union identifier

- 9: Check digit

Practical Uses of ABA Numbers

ABA numbers are utilized in a variety of financial transactions, including:

- Direct Deposits: Ensuring your salary or other payments are deposited directly into your account.

- Wire Transfers: Facilitating the transfer of funds between accounts at different institutions.

- Automatic Bill Payments: Allowing you to pay bills automatically without manual intervention.

- Check Processing: Verifying the authenticity of checks and routing them to the correct bank.

- ACH (Automated Clearing House) Transactions: Enabling electronic transfers between accounts.

Each of these transactions relies on the ABA number to ensure that funds are routed to the correct institution, maintaining the integrity of the financial system.

How to Locate Your ABA Number

Identifying your ABA number is a straightforward process. Here are several methods you can use:

- Check: The ABA number is typically printed on the bottom left corner of your checks.

- Bank Statement: Your ABA number may also appear on your monthly bank statement.

- Bank Website: Many banks provide ABA numbers on their websites for easy access.

- Customer Service: Contact your bank's customer service department for assistance in locating your ABA number.

Tips for Verifying Your ABA Number

When verifying your ABA number, it's important to ensure that you're using the correct number for the specific type of transaction you're conducting. Some banks may have different ABA numbers for wire transfers and ACH transactions, so it's crucial to confirm which number to use.

Differences Between ABA and ACH Numbers

While ABA numbers and ACH numbers are often used interchangeably, they serve distinct purposes:

- ABA Number: A unique identifier for a bank or credit union, used for routing transactions.

- ACH Number: A number specifically designed for electronic transactions processed through the Automated Clearing House network.

For most transactions, the ABA number and ACH number are the same. However, some banks may use different numbers for wire transfers and ACH transactions, so it's important to verify the appropriate number for your specific needs.

Key Differences Between ABA and ACH Transactions

ABA numbers are used for a broader range of transactions, while ACH numbers are tailored for electronic transfers. Understanding the distinction between the two can help ensure that your transactions are processed correctly and efficiently.

Why ABA Numbers Are Crucial

ABA numbers are vital for maintaining the integrity and efficiency of the financial system. They ensure that funds are routed to the correct institution, minimizing the risk of errors and delays. Additionally, ABA numbers help prevent fraud by providing a standardized method for identifying financial institutions.

For both businesses and individuals, understanding ABA numbers is essential for effective financial management. Whether you're setting up direct deposits, automating bill payments, or transferring money between accounts, the ABA number plays a critical role in ensuring the accuracy and reliability of your transactions.

Ensuring the Security of Your ABA Number

While ABA numbers are indispensable for financial transactions, they must be handled with care to protect sensitive information. Sharing your ABA number with unauthorized parties can lead to fraud or unauthorized access to your accounts.

To safeguard your ABA number:

- Only share it with trusted institutions or individuals.

- Exercise caution when providing your ABA number online or over the phone.

- Monitor your accounts regularly for any suspicious activity.

Frequently Asked Questions About ABA Numbers

Q1: Can I use the same ABA number for all types of transactions?

Not necessarily. Some banks have different ABA numbers for wire transfers and ACH transactions. Always confirm which number to use based on the specific type of transaction you're conducting.

Q2: What happens if I use the wrong ABA number?

Using the wrong ABA number can result in delayed or failed transactions. It's crucial to verify the correct number before initiating any financial transaction to avoid complications.

Q3: Are ABA numbers unique to each bank?

Yes, ABA numbers are unique identifiers assigned to each financial institution. This ensures that transactions are routed to the correct bank or credit union, maintaining the accuracy and reliability of the financial system.

Final Thoughts

Having a solid understanding of ABA numbers and their role in the financial system is essential for managing your finances effectively. From facilitating seamless transactions to ensuring the security of your accounts, ABA numbers are a critical component of modern banking.

We encourage you to review your ABA number and ensure its accuracy for all your financial transactions. If you have further questions or need clarification, feel free to leave a comment below. Additionally, explore our other articles for more insights into financial management and banking systems.

Remember, staying informed about financial tools like ABA numbers empowers you to make better financial decisions. Share this article with others who may benefit from understanding the importance of ABA numbers in banking transactions.