Applying for a Merrick credit card is a pivotal step in enhancing your financial stability and creditworthiness. Whether your goal is to build credit, enjoy exclusive rewards, or experience the convenience of a credit card, understanding the intricacies of the application process is essential. This guide will provide a detailed overview of Merrick credit card applications, equipping you with the knowledge to make a well-informed decision.

Merrick credit cards are celebrated for their adaptability and inclusivity, catering to individuals from diverse credit backgrounds. Whether you're new to credit or aiming to rebuild your financial standing, Merrick credit cards offer a reliable solution. By gaining a thorough understanding of the application process, you can significantly enhance your likelihood of approval and secure favorable terms.

This article will explore the nuances of Merrick credit card applications, addressing topics such as eligibility criteria, strategies for improving your application, and the advantages of choosing Merrick credit cards. Whether you're a first-time applicant or someone seeking to enhance your current credit options, this guide will provide valuable insights. Let’s delve into the world of Merrick credit cards and navigate the application process effectively.

Read also:Discover The Legacy Of Service Memorial Institute A Beacon Of Remembrance And Excellence

Table of Contents

- Exploring Merrick Credit Card Applications

- Eligibility Criteria for Merrick Credit Cards

- Why Choose Merrick Credit Cards?

- Navigating the Merrick Credit Card Application Process

- Maximizing Your Application Success

- Addressing Common Challenges

- Exploring Alternatives to Merrick Credit Cards

- Frequently Asked Questions

- Key Statistics About Credit Card Applications

- Final Thoughts and Recommendations

Exploring Merrick Credit Card Applications

Understanding the fundamentals of Merrick credit card applications is crucial for anyone considering this financial tool. Merrick credit cards are designed to accommodate a wide spectrum of consumers, from individuals with limited credit histories to those seeking premium features. The application process is straightforward but requires meticulous attention to detail for optimal results.

One of the standout features of Merrick credit cards is their accessibility. Unlike some major credit card issuers, Merrick offers viable options for individuals with less-than-ideal credit scores, providing an opportunity for financial rehabilitation and credit building. This section will examine the core aspects of Merrick credit cards, including their target audience, available features, and how they stack up against other credit card offerings in the market.

Eligibility Criteria for Merrick Credit Cards

Assessing Your Credit Profile

Before embarking on the application journey, it’s essential to evaluate your credit profile. Eligibility requirements may vary depending on the specific card you’re applying for, but key factors such as credit score, income, and debt-to-income ratio significantly influence the approval process.

- Credit Score: While Merrick credit cards are more accommodating than many competitors, maintaining a reasonable credit score can considerably enhance your approval chances.

- Income Verification: Providing evidence of stable income is imperative. Lenders need assurance that you can handle monthly payments responsibly.

- Debt-to-Income Ratio: A lower debt-to-income ratio can strengthen your application and improve your creditworthiness.

Additional Eligibility Considerations

Other factors, such as employment history and existing credit relationships, may also play a role in the approval decision. Familiarizing yourself with these requirements can empower you to present a stronger application and increase your chances of success.

Why Choose Merrick Credit Cards?

Merrick credit cards offer a plethora of advantages that make them an appealing option for numerous consumers. From flexible payment terms to rewarding programs, these cards cater to a wide range of financial needs and lifestyles.

Read also:Tekoa Country Club Your Ultimate Guide To Golfing And Community In Westfield Ma

- Customizable Credit Limits: Merrick credit cards often provide adjustable credit limits tailored to your financial circumstances.

- Competitive Interest Rates: For individuals with solid credit, Merrick offers competitive interest rates compared to other subprime lenders, ensuring affordability.

- Exceptional Customer Support: Merrick is renowned for its responsive and supportive customer service, ensuring cardholders receive timely assistance when needed.

By opting for Merrick, you gain access to a dependable financial partner committed to your success and financial well-being.

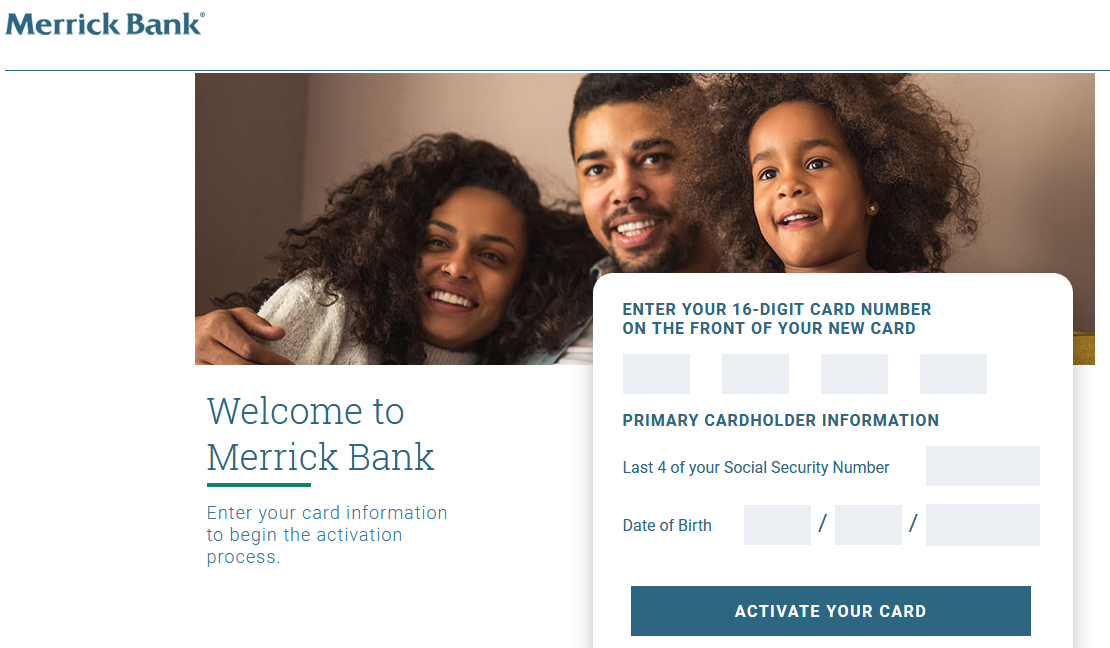

Navigating the Merrick Credit Card Application Process

Step-by-Step Application Guide

The Merrick credit card application process is designed to be user-friendly, but adhering to the correct steps can enhance your experience. Below is a comprehensive breakdown of the process:

- Research Available Cards: Identify the Merrick credit card that aligns with your financial aspirations and lifestyle.

- Gather Necessary Documents: Ensure you have all required personal information, income verification, and identification documents at hand.

- Submit Your Application: Complete the online or offline application form accurately and submit it for evaluation.

- Review Decision: Merrick typically provides a decision within a few days, and in some cases, instantly for online applications.

Avoiding Common Application Pitfalls

Steer clear of common mistakes such as incomplete forms, inaccurate information, or omitting relevant financial details. These errors can delay your application or lead to denial. By being thorough and meticulous, you can ensure a smoother application process.

Maximizing Your Application Success

To increase your chances of approval, consider the following strategies:

- Enhance Your Credit Score: Pay off existing debts and resolve any inaccuracies on your credit report to boost your credit score.

- Display Financial Stability: Provide comprehensive income documentation to demonstrate your capacity to manage payments responsibly.

- Select the Right Card: Choose a Merrick credit card that matches your financial profile and objectives for optimal results.

By preparing diligently and addressing potential concerns, you can significantly improve the likelihood of your application’s success.

Addressing Common Challenges

Handling Denied Applications

Receiving a denied application can be disheartening, but it’s not the end of the road. Review the reasons provided by Merrick and take proactive steps to address them. Improving your credit score, reducing debt, or increasing income can enhance future applications and improve your chances of approval.

Lost or Stolen Cards

In the event of a lost or stolen card, promptly contact Merrick’s customer service to report the issue and request a replacement. Acting swiftly can prevent unauthorized transactions and safeguard your financial security.

Exploring Alternatives to Merrick Credit Cards

While Merrick credit cards are a commendable choice, exploring alternative options can provide additional opportunities. Consider other subprime lenders or secured credit cards if you’re focused on building credit. Conduct thorough research to identify the best fit for your financial situation and goals.

Frequently Asked Questions

What Happens After I Submit My Application?

Upon submitting your Merrick credit card application, the lender will review your information and make a decision. You will receive a notification via email or mail, depending on the application method. This process typically takes a few days, and in some cases, may be expedited for online applications.

Is It Advisable to Apply for Multiple Cards Simultaneously?

While you have the option to apply for multiple Merrick credit cards, doing so may negatively impact your credit score. It’s recommended to focus on one application at a time to minimize unnecessary inquiries and optimize your chances of approval.

Key Statistics About Credit Card Applications

Recent studies indicate that approximately 60% of credit card applications are approved, with higher approval rates for applicants with good or excellent credit scores. These statistics highlight the importance of preparation and underscore the value of understanding your credit profile before applying.

Final Thoughts and Recommendations

In summary, mastering the Merrick credit card application process involves strategic planning and meticulous attention to detail. By comprehending eligibility requirements, gathering your financial documentation, and leveraging the tips outlined in this guide, you can enhance your chances of approval and secure a credit card that aligns with your needs.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, explore other articles on our site for further insights into personal finance and credit management. Together, let’s empower ourselves to take control of our financial futures and make informed decisions that yield long-term benefits.