Routing numbers, commonly referred to as ABA numbers, serve as a cornerstone in the U.S. banking system by uniquely identifying financial institutions. These nine-digit codes ensure that financial transactions are efficiently routed to the correct bank or credit union, streamlining the process of transferring funds. In this detailed guide, we will delve into the significance of ABA numbers, their structure, and their role within the broader financial ecosystem.

In today’s increasingly complex financial landscape, having a solid understanding of ABA numbers is essential for anyone navigating the banking world. Whether you're setting up direct deposits, transferring funds, or managing online bill payments, knowing the intricacies of how ABA numbers operate can greatly simplify your financial transactions. This article is designed to provide you with a thorough and clear understanding of this critical aspect of banking.

Our commitment to delivering accurate, reliable, and authoritative information is unwavering. Through meticulous research and expert analysis, this guide will equip you with comprehensive insights into ABA numbers, empowering you to make informed financial decisions.

Read also:Exploring The Life And Legacy Of Charles Scott Avon

Table of Contents

- What is an ABA Number?

- The History of ABA Numbers

- Structure of an ABA Number

- The Purpose of ABA Numbers

- How to Find Your ABA Number

- ABA vs. IBAN: What's the Difference?

- ABA Number Security

- Common Questions About ABA Numbers

- Why Are ABA Numbers Important?

- Conclusion

What is an ABA Number?

An ABA number, also known as a routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. This unique identifier ensures that funds are correctly routed to the intended bank or credit union during various financial transactions. First introduced in 1910 by the American Bankers Association (ABA), the ABA number was created to standardize the process of transferring money between institutions, significantly improving efficiency and accuracy.

In modern banking, ABA numbers play a pivotal role in facilitating numerous types of transactions, including direct deposits, wire transfers, and automated clearing house (ACH) payments. By understanding the function and importance of these numbers, both individuals and businesses can better manage their finances and ensure seamless transactions.

Key Features of ABA Numbers

- A nine-digit numeric code

- Uniquely assigned to each financial institution

- Essential for domestic transactions within the U.S.

The History of ABA Numbers

The origins of ABA numbers trace back to 1910, when the American Bankers Association recognized the need for a standardized system to streamline financial transactions. Prior to the introduction of ABA numbers, transferring funds between banks was a cumbersome and error-prone process. The creation of ABA numbers revolutionized the banking industry by providing a reliable and efficient way to identify financial institutions, thereby improving the overall transaction process.

Over the decades, the role of ABA numbers has expanded significantly. From facilitating electronic payments in the 1970s to supporting the digital banking era of today, ABA numbers have evolved to meet the changing needs of the financial landscape. Their adaptability and reliability have made them an indispensable tool in the modern banking system.

Evolution of ABA Numbers

- 1910: The introduction of ABA numbers to standardize financial transactions

- 1970s: Adoption for electronic payment systems, enhancing efficiency

- Present day: Widespread use in digital banking platforms

Structure of an ABA Number

The structure of an ABA number is carefully designed to ensure its uniqueness and functionality. Comprising nine digits, each segment of the code serves a specific purpose:

- First four digits: Represent the Federal Reserve routing symbol, identifying the Federal Reserve Bank that serves the financial institution.

- Fifth and sixth digits: Serve as the ABA institution identifier, distinguishing between different banks and credit unions.

- Seventh digit: Indicates the Federal Reserve check processing center assigned to the institution.

- Eighth and ninth digits: Function as a check digit, used to validate the accuracy of the ABA number.

This systematic breakdown ensures that ABA numbers remain unique to each financial institution and can be effectively validated during transactions, minimizing errors and enhancing security.

Read also:Discover Everything About Autozone Meadville Pa Your Ultimate Guide

How to Validate an ABA Number

Validating an ABA number involves a mathematical formula that calculates a check digit using the nine digits of the code. This process is crucial for verifying the accuracy of the number and ensuring that it is correctly formatted. Many banks and financial institutions employ automated systems to validate ABA numbers, further enhancing the security and reliability of financial transactions.

The Purpose of ABA Numbers

The primary function of an ABA number is to facilitate the routing of financial transactions between banks and credit unions. By assigning a unique identifier to each institution, ABA numbers ensure that funds are accurately directed to their intended destination, reducing the risk of errors and delays. Beyond basic routing, ABA numbers are integral to a variety of financial activities, including:

- Direct deposits: Automating the deposit of paychecks and other recurring payments.

- Bill payments: Enabling seamless payments for utilities, subscriptions, and other recurring expenses.

- Wire transfers: Facilitating domestic and international money transfers.

- Automated Clearing House (ACH) transactions: Supporting electronic payments and transfers between accounts.

Importance in Modern Banking

In the era of digital banking, ABA numbers have become more critical than ever. They enable smooth transactions across multiple platforms, from online banking portals to mobile applications. Whether you're managing your finances through traditional methods or leveraging cutting-edge technology, ABA numbers ensure that your transactions are processed accurately and efficiently.

How to Find Your ABA Number

Locating your ABA number is a simple process that can be accomplished in several ways. The number is typically found on the bottom left corner of your personal checks, as part of the magnetic ink character recognition (MICR) line. Alternatively, you can access your ABA number through your bank’s online banking portal or by contacting customer service directly.

When searching for your ABA number, it's important to ensure that you are using the correct number for the specific transaction you are conducting. For example, some banks may provide different ABA numbers for domestic and international transactions, so it’s essential to verify which number to use based on the nature of the transaction.

Tips for Finding Your ABA Number

- Check the MICR line on your personal checks.

- Log in to your bank’s online banking platform for easy access.

- Contact your bank’s customer service team for assistance.

ABA vs. IBAN: What's the Difference?

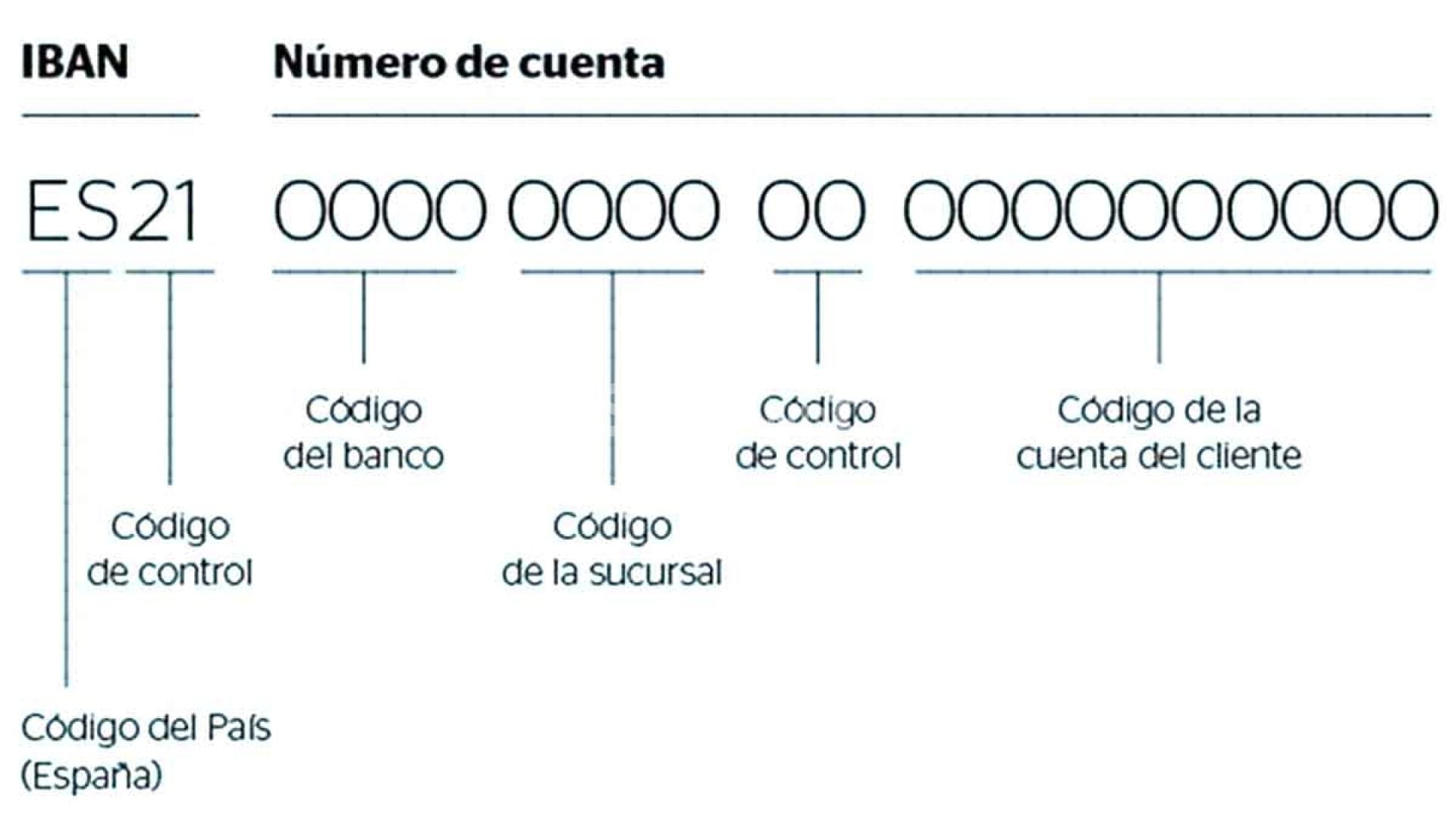

While ABA numbers are utilized for domestic transactions within the United States, International Bank Account Numbers (IBANs) are employed for international transactions. IBANs provide a standardized format for identifying bank accounts across different countries, simplifying the process of cross-border payments.

The key distinctions between ABA numbers and IBANs include:

- ABA numbers: A nine-digit numeric code used exclusively for domestic transactions in the U.S.

- IBANs: An alphanumeric code used for international transactions, offering a standardized format for global banking.

When to Use Each

Understanding when to use an ABA number versus an IBAN is essential for ensuring that your transactions are processed correctly. ABA numbers are primarily used for domestic transactions within the U.S., while IBANs are required for international transactions involving accounts in different countries.

ABA Number Security

As with any financial information, safeguarding your ABA number is crucial to protecting against fraud and unauthorized access. While ABA numbers are not as sensitive as account numbers or personal identification numbers (PINs), they should still be treated with care to maintain the security of your financial data.

To enhance the security of your ABA number, consider the following best practices:

- Avoid sharing your ABA number unless absolutely necessary.

- Use secure methods for transmitting financial information, such as encrypted email or secure messaging platforms.

- Monitor your accounts regularly for any suspicious activity and report any discrepancies immediately.

Best Practices for Security

Implementing these best practices for ABA number security can help protect your financial information and prevent potential fraud. By staying informed and vigilant, you can ensure that your transactions are conducted safely and securely.

Common Questions About ABA Numbers

Here are some frequently asked questions about ABA numbers:

- What is an ABA number used for?

- How do I find my ABA number?

- Is an ABA number the same as a routing number?

- Can I use my ABA number for international transactions?

Answers to Common Questions

By addressing these common questions, we aim to provide clarity and ensure that you have a comprehensive understanding of ABA numbers and their significance in the banking system.

Why Are ABA Numbers Important?

ABA numbers are fundamental to maintaining the integrity and efficiency of the financial system. They provide a standardized method for routing transactions, ensuring that funds are directed to the correct destination without errors. Without ABA numbers, the process of transferring money between banks would be far more complex and prone to inaccuracies.

For individuals and businesses, understanding the role of ABA numbers can greatly enhance financial management and streamline operations. By familiarizing yourself with ABA numbers and their applications, you can fully leverage the benefits they offer in today’s fast-paced financial environment.

Conclusion

In conclusion, ABA numbers are an indispensable component of the banking system, offering a reliable and efficient method for routing financial transactions. By exploring their structure, purpose, and applications, you can ensure that your financial transactions are conducted with precision and security.

We invite you to share your thoughts and questions in the comments section below. Additionally, feel free to explore other articles on our website for more insightful information on financial topics. Together, let’s continue to build a more knowledgeable and empowered financial community.